Back in 1982, the ABS Survey of Income and Housing revealed that 168,000 or 10% of home buyers spent more than 30% of their gross household income on housing costs. Nearly 30 years later in 2011 these numbers had soared to 640,000, equivalent to 21% of all home buyers. According to the same ABS data source, households in 1990 on average valued their homes at a multiple that was four times their average household income. By 2011 this multiple had climbed to nearly six times average household income.

The common response to the shortage of affordable housing is restricted supply, but, as this article in ‘The Conversation” points out, it’s much more complicated than that.

Update Jan 2020.

The conventional wisdom is that home ownership is an aspiration of every Australian but, as investors, both overseas [especially Chinese] and local have made residential property a new asset class, it has become too expensive for ordinary workers to realize their dream. There are those who say [mostly bankers and politicians with multiple negatively geared properties] that the economy suffers if house prices fall. Consider the comparison of two investors, the first chooses to invest in bank shares, the second in residential property. Both suffer significant capital losses. For some reason the property pundits tell us that only the second investor deserves any sympathy, that it is only a temporary set back and that the market will turn and all will be well in the future.

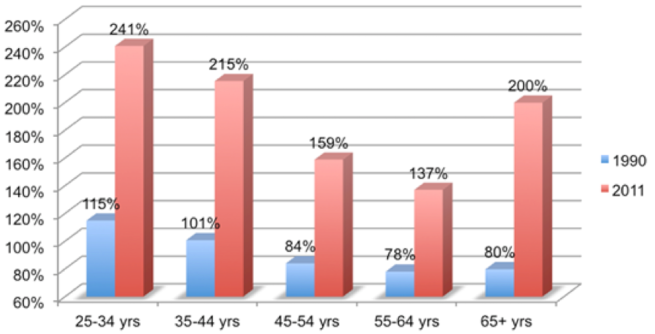

Fiscal concessions in the form of capital gains and land tax exemptions to home owners, negative gearing and concessionary capital gains tax for ‘mum and dad’ investors, and asset test concessions to home owner retirees offer powerful incentives to accumulate wealth in housing assets. We are left with a problem that has wider ramifications because it has created a housing system saddled with growing indebtedness. In the 21 years illustrated in the chart below the average mortgage debt has soared relative to the average household incomes of mortgagors in all age groups.

Repayment risks and investment risks [house values falling short of outstanding mortgage debt] loom more prominently, and for a larger number of precariously positioned households. These risks could test the resilience of local economies and the national economy. But what do we hear from those in the industry? We need more assistance from Government, they plead. Bigger First Home Owner grants, First Home Loan Deposit Schemes, recognizing all the time that the only people benefiting are the property owners.

It’s time somebody took everyone aside and told them the facts. The existing market is a Ponzi scheme financed by the banks that has meant ordinary people will never own their own home.