Andrew Liveris and former NT chief minister Paul Henderson will head the eight-person Economic Reconstruction Commission, which aims to attract investment to the Territory and create local jobs post-pandemic. An interim report prepared for the National COVID-19 Coordination Commission [NCCC], a taskforce chaired by WA businessman Nev Power, a director and shareholder of Strike Energy, which could benefit from government investment subsidies. The report advocated for relaxation of fracking regulations to allow for more rapid gas extraction from [among others] the Beetaloo Basin. The commission’s special advisor on manufacturing renewal, former Dow Chemical global chairman and CEO Andrew Liveris, is deputy chairman of the world’s biggest oil and gas consultancy and engineering firm, Worley, and is also a director of Saudi Aramco, the world’s biggest oil and gas company, which has ambitions to invest in Australia.

The vision of the taskforce is that gas development goes hand-in-hand with development of energy-intensive manufacturing industries, including chemicals and ‘mineral tech’. But the NCCC’s emphasis on a ‘gas-led manufacturing recovery’, a call for government subsidies and relaxing of environmental controls, has drawn severe criticism from green energy advocacy groups. “It’s a blueprint for the gas industry, it’s not a manufacturing blueprint, it’s pathetic,” said Tim Buckley, director of energy research at the Institute for Energy Economics and Financial Analysis, who spent 30 years in senior roles in investment banking. Bruce Robertson began investigating the Australian gas industry eight years ago when he found gas prices in Australia were not comparable with prices globally. Since then, he’s uncovered what amounts to a price fixing gas cartel operating on the east coast of Australia, which has enabled the on-sell of Australian gas supplies to overseas customers without the returns in royalties or tax, and in so doing has limited supply and raised prices for Australian domestic and manufacturing customers. “There are a couple of ways to fix both prices and the supply of gas in Australia without developing new sources,” says Robertson. “A gas-led recovery is NOT one of those ways. It is unbelievable how silly this proposal is from the COVID Commission.” Robertson says Australia’s economic recovery needs to focus on industries which are already doing well. “Gas and LNG prices have bottomed globally, and companies everywhere are virtually giving gas away,” says Robertson. “This will continue for at least eight years due to the massive over supply in gas globally.”

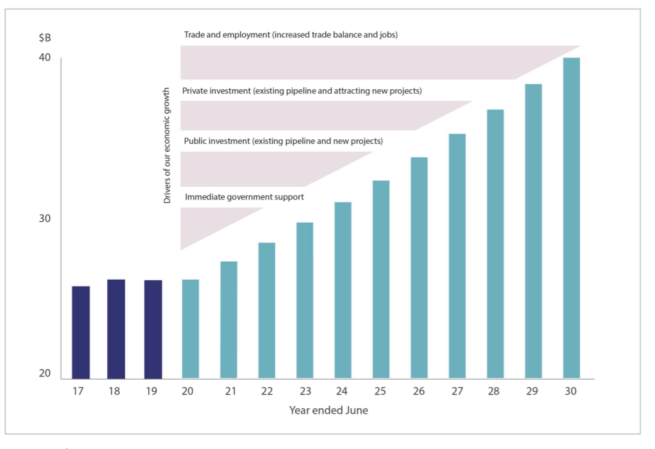

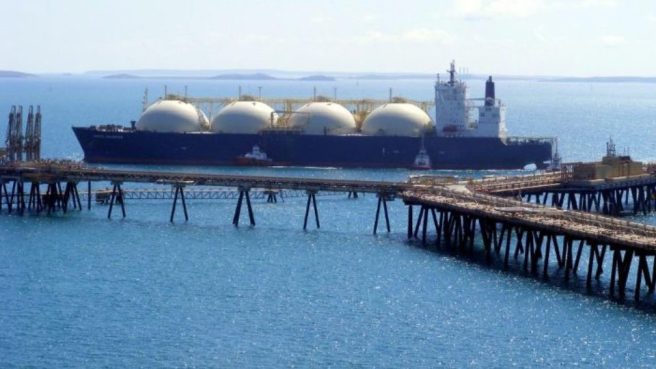

The Chief Minister said the Territory had a $26 billion economy now, but it could be a $40 billion economy by 2030 with 35,000 new jobs. World champions in LNG production: great news for the economy, you might think, with those rivers of resource royalties flowing in to government coffers. The reality, though, is vastly different. In 2017-18, LNG companies in Australia had revenue totalling almost $30 billion, yet paid just $1 billion in royalties levied under the petroleum resource rent tax [PRRT]. By comparison, Qatar, which exports about the same as Australia production, collected a staggering $26 billion in royalties. A report by consultants ACIL Allen predicted INPEX will export $195 billion of products out of Darwin over the next three decades, but would not pay a cent in royalties to the federal government – in its lifetime.

As the PRRT is levied on a company’s profits, rather than production, gas producers deftly structured their balance sheets to minimise profits within their Australian operations. The only solution for the PRRT is basically to scrap it and start over again with a proper royalties scheme. And what was also galling was the fact that 87 per cent of new LNG projects in Australia were owned by foreign multinationals. The LNG companies are pumping out the world’s largest volumes and essentially paying nothing for it, and their justification is that they have poured billions of dollars into infrastructure and need to recoup those investment costs. Chevron and ExxonMobil have openly admitted to the government that they don’t expect to pay any PRRT until the mid-2030’s.

This is, according to the 23 page document, what Operation Rebound is all about: doing whatever it takes to recover, rebuild and rebound so the Territory economy is stronger in the future. But unfortunately, even if the economy is grown to $40 billion, if the royalty arrangements remain the same, actual INCOME, will hardly increase at all. What is needed is a new vision. Leadership that considers citizens first and foremost. People like Andrew Liveris and Nev Power are captives of the corporations that made them rich. Their view on the pandemic is ‘you’re all in this together’ and the last to be affected will be the political and corporate elites. Ordinary Territorians are bearing the brunt of the economic effects of the pandemic – have big business, banks, aviation, mining etc. reduced management salaries, taken no directors fees, shared the pain?

We need a new model, perhaps Norway has an answer.

We need a new model, perhaps Norway has an answer.

The problem is that this Government seems completely unable to convert a plan into an outcome. The plan calls for,

-

establishing a Major Project Coordinator

-

strategic investments to advance the Territory’s potential

-

early investment in critical enabling infrastructure

-

build and capitalise on projects [that have been on paper for years]

-

harness the economic advantages of the new CDU City Campus

-

grow tourism and education opportunities

-

supporting the creative industries sector

-

develop and enhance medical and medical research facilities

-

increasing skills investment

-

supporting Traditional Owners and Land Councils

A number of projects have achieved most of their approvals, but are seeking financial investment. TNG, Seafarms, Core Lithium, Arafura Resources and KGL Copper are all well placed to advance, Verdant’s Amaroo Phosphate project has secured finance, and Sun Cable continues to progress through its feasibility and approval processes. The Territory will be working closely with the Australian Government to identify financing mechanisms to achieve a strong recovery, such as renewable energy investment through Arena and the National Water Infrastructure Fund. The Northern Australia Infrastructure Facility [NAIF] still has over $3 billion available to invest, and the Critical Minerals Facilitation Office has access to a $4 billion facility through the Export Finance Agency for investment in this emerging mineral sector.

Add in cheap finance through CEFC and it would seem that plenty of investment is available to partner private investment; why is it that nothing ever gets done?

The plan continues;

We will intensify our engagement with private equity and debt finance providers to give them the confidence to invest in the Territory. To ensure this strategy is set up for success the Territory Economic Reconstruction Commission will be established. The Commission will investigate and advise on the range of factors that could be addressed to ensure a rapid recovery takes place such as government policy reform, priority infrastructure, access to land, regulatory approvals and the availability of finance.

The Territory has tried these ‘expert panels’ before. Who can forget the Green Energy Task Force [created by the co-chair Paul Henderson] that worked for two years to produce a roadmap for renewable energy that was thrown in the bin as soon as the Government changed, revived when Labor got back in and now exemplifies how unimportant ‘expert panels’ become in the effluxion of time. Then there was the Economic Summit in 2017, the circus organised by Luke Bowen, that was to show the way forward for the new Gunner Government.

In November 2018, the NT Government established the Fiscal Strategy Panel, chaired by John Langoulant, to provide an independent assessment of the NT’s fiscal outlook and develop a plan for budget repair.

A separate ‘root and branch review’ identified $1.4 billion in savings measures that was to result in 52 of the Northern Territory’s 643 executive-level public servants, whose annual salary packages range from $217,000 to $391,000, being axed within 12 months. Didn’t happen! Another 120 public service jobs to go over the next four years, and another 300 positions abolished. Rolf Gerritsen, the former political adviser to ex-chief minister Clare Martin and research fellow at the Northern Institute, said he was doubtful the reforms could be sustained across future election cycles. Any reasonable voter would ask “why will another expert panel work when all the others, particularly the most recent, have failed spectacularly.

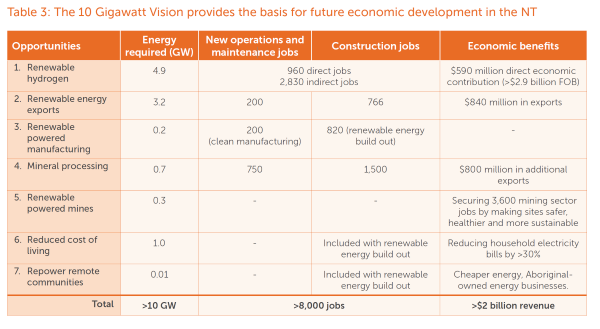

Of particular interest is the presence on the panel of Beyond Zero Emissions CEO  Eytan Lenko [who has a successful technical, business and entrepreneurship background and is a long running advocate for action on climate change] has already put before Government a report entitled ‘Repowering the NT’ in which many of the items listed for discussion by the new Commission have already been proposed.

Eytan Lenko [who has a successful technical, business and entrepreneurship background and is a long running advocate for action on climate change] has already put before Government a report entitled ‘Repowering the NT’ in which many of the items listed for discussion by the new Commission have already been proposed.

The 10 Gigawatt Vision is a sustainable alternative to economic strategies based on fossil fuels. It points out that shale gas industry is financially unstable and totally unsuited to the needs of the coming zero-carbon economy.

Along with every other ‘plan for recovery’ this new exercise is destined to be a NATO project: no action, talk only. All the meetings, all the discussion papers, all the summits and expert panels have but one purpose – to delay actually doing something.

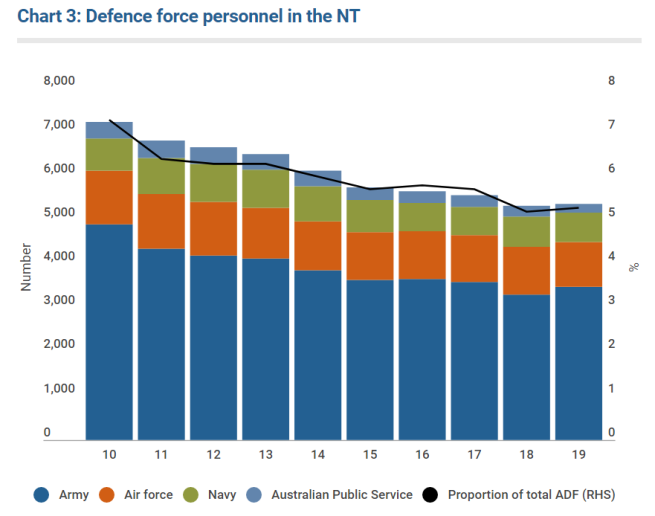

Jobs and growth are meaningless in the face of declining population and stifling regulation, be it by Government or the Land Councils. The loss of uniforms has had a much more deleterious affect than the cessation of work at Wickam Point. The FIFO’s were always going to leave, it was just a matter of time and yet there seemed to be little discussion about the affect of the DHA on the residential property market.

In light of the current situation, government inaction on the Territory’s housing affordability crisis is indefensible. The housing market must respond in a timely manner to home buyer need rather than speculator demand. Fundamental reforms are required to reduce the propensity toward volatile boom and bust land cycles fueled by speculation and unsustainable levels of household debt. These reforms could be revenue neutral if ;

[a] current transaction taxes were replaced with a holding tax levied on the unimproved value of land and

[b] the NT government guaranteed Housing Supply Bonds that encouraged long term investment by institutions.

The other major deficiency in any discussion of the economy is the disturbing lack of transparency of Government/business deals. No serious outsider is going to make any significant investments in the NT while the environment is tainted by the slime of corruption and bribery. The whole land development process is opaque and riddled with backhanders and “wink, wink, nudge, nudge” associations. The worst examples seem to involve a select few who, regardless of the party in power, have made, and continue to make, a fortune from dealing in a resource that belongs to the state, and therefore to the taxpayers, our land. Witness the litigation between Robinson and the Feds; and why was $5 million paid to the company that stands to make $100’s of millions profits from the development of Berrimah Farm? No doubt the donations made by Darwin Corporate Park and Berrimah North were above board but the perception is that these sorts of donations must be made in order to do business in the NT.

The highest priority must be given to complete and continuing transparency of all transactions that involve rezoning rights rather than being decided behind closed doors as at present. There is an argument for creation of a “betterment tax”, briefly considered by the Henry tax review, that would see rezoning triggering a fee that amounts to the value gain, payable by the landowner when they develop or sell the land. There remains this slavish attachment to the concept that Government and industry can work together to improve the economy. Firstly Government is bereft of ideas and secondly, the vast majority of businesses in the NT are so small their owners are flat out keeping the wolf from the door. Never has the old Territorian epithet been more apposite: “when you’re up to your arse in crocodiles, it’s difficult to remember the original intention was to drain the swamp”.

If you want financial advice about any other asset class, shares, derivatives, etc. the provider must comply with very

If you want financial advice about any other asset class, shares, derivatives, etc. the provider must comply with very