Which will it be? According to the Prime Minister the changes to negative gearing proposed by Labor will “be a wrecking ball”, smashing house prices and reducing the value of every Australian house. On the contrary, says the Assistant Treasurer, house prices will rise, making it even more difficult for first home buyers. It is evident that the Coalition has no idea and, instead of proposing a policy that will assist in budget repair, they’re reverting to what was successful last time, reducing the discussion to a three word slogan.

The situation is further complicated by the Property Council modeling showing 30,000 landlords in Darwin and Alice being affected. NT Director, Ruth Palmer is reported to have said changes to the rules would reduce supply, just as the market was in need of more investors. “Most people who buy an investment property are mums and dads who are trying … not to be a burden on taxpayers”, she said. Firstly, there is no evidence that restricting negative gearing to new housing will reduce supply, the market will simply change to home buyers rather than investors. Secondly, those who speculate in the housing market transfer their income tax liability disproportionately to those who spend all they earn on the necessities [including inflated rents] leaving no surplus to fund a negative geared investment, even if they wanted to.

Some mums and dads, who do not understand negative gearing, may be harmed when the inevitable decrease in capital values occurs if they have been ill advised by investment property spruikers and irresponsible accountants. Anyone who has invested long term in a principal place of residence will not need to sell their home and therefore not suffer any depreciation in value. The only ‘older’ people who will get caned are those greedy individuals who have used their super for speculative investment properties rather than creating an income stream. Falling housing prices may temporarily inconvenience a few but the benefit of making more housing affordable clearly outweighs that inconvenience. In summary, the Grattan Report [upon which the Labor policy is based] concludes that negative gearing had it’s place but now is distorting the property market and making home ownership impossible for those who need it most. The argument against negative gearing then becomes a moral rather than economic issue.

What’s wrong with negative gearing? It’s simply income tax 101, right? This is the real genius of the scam because of the way negative gearing works and its role – effectively making mum and dad investors feel comfortable about carrying loss-making properties – it has become a much discussed topic. And the vested interests that benefit most have worked hard to make sure that it stays at the front of voters minds. In all that energy and hoo-ha around negative gearing, they’ve managed to distract the punters from the real issues involved. As far as the rich and powerful are concerned, there’s no debate. The negative gearing “controversy” is nothing but orchestrated theater. Smoke and mirrors. But if you take a peep inside the magician’s box and get to understand the actual mechanics of the scam, you’ll see how Joe Public’s been taken for a ride. But to appreciate how beautiful the scam is, we need to step back and see it in context.

On a global and historical scale, the past twenty years have been one of the great bull runs of all time. House prices have effectively tripled since the late 80’s. So there has never been a better time to be a property investor… ever… in the history of Australia. All of this should have sparked a virtuous cycle of investment, increased net wealth and economic growth. But it didn’t, creating one of the great puzzles of our times. If these have been the best times to be a property investor in history, why haven’t investors done better? And by better, what is meant, why haven’t they used these conditions to expand and diversify their portfolios, develop passive lifestyle incomes and put their feet up? Household debt is through the roof.

As the rising cost of living and flat wages growth phenomenon intensifies, Australian households are likely to draw down on existing savings to fund their current lifestyle and expenditure commitments, rather than substantially cut back on existing financial commitments.

Approximately $AUD 500 billion of interest interest-only loans which were underwritten during 2013-2016, are expected to come due in the coming four years (i.e. 2018 – 2021). Given the crackdown on interest-only loans by the APRA, many households over the coming four years will be required to convert their interest-only mortgage to a principal and interest loan which will result in an increased mortgage repayment. According to RBA estimates, this conversion from interest-only to principal and interest mortgages will, on average, add $AUD 7000 in additional annual mortgage repayments. For most households without sufficient income to meet these repayment increases, households will be forced to draw down on available savings thus eroding any financial buffer which these households may currently enjoy.

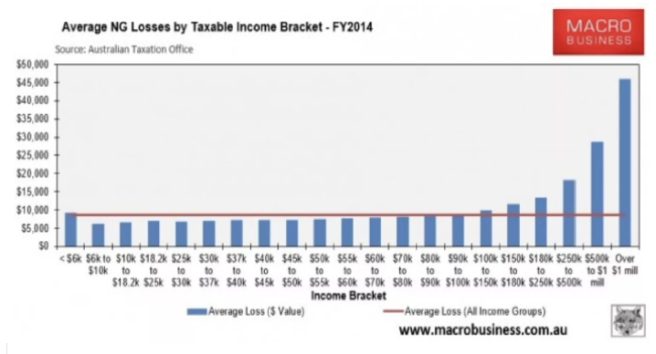

What the data shows is that 95% of investors don’t get past two properties. Of those that do, most don’t do all that much better. Only 2% of investors get to four properties. And less than 1% become portfolio investors with 5 or more properties. The question is why. If these have been the best market conditions in history, why have 95% of investors not been able to get past two properties? Two-thirds of investors report an income loss on their investment properties. The average negatively geared investor loses $10,947 a year or $210.50 a week. Many lose a lot more. … and everybody’s getting screwed. Negative Gearing was sold to investors as a “professional” play. The man in the street thought he was playing with the big boys. It was a clever way to mess with the tax man, and that’s what rich people do, right?

A lot has been written over the years about why negative gearing is a dud strategy – about the way people underestimate the operating losses involved, or the way it leaves them exposed if something goes wrong – like someone losing their job, or banks increasing rates. If all your properties are bleeding cash, at some point the banks are going to stop lending to you. You hit up against a serviceability ceiling. The problem is that macro-economic factors have done a lot to disguise how dangerous negative gearing is. With interest rates on a steady downward run and rents growing at a decent clip, negatively geared properties can become positively geared in a few years. And once they become positively geared you can draw down on the equity and diversify your portfolio. But interest rates are as low as they can go and rental growth is stagnating, so investors can no longer rely on those macro-economic tail-winds going forward. If our obsession with negative gearing continues, two-thirds of property investors are going to find themselves seriously exposed.

Through one of the great property bull runs in history, 95% of investors couldn’t get past two properties. So that raises the question. If it’s not serving individual investors, who is it serving? To understand how the scam works in practice, you need to understand how negative gearing works with the Capital Gains Tax discount. Saving income tax is not really the issue. We’re just made to think it is. This stuff is made dense and boring by design. Saving tax is only a by-product of the scam, it’s really all about capital gain. If the property rises in value more than the accumulated losses then you win: if not [i.e. the negative income exceeds the increase in capital gain], you lose! It’s difficult to penetrate, which is why it has survived so long. The 50% CGT discount was introduced by the Howard Government in 1999, and it was what allowed negative gearing to be used as a “sheltering tax haven” [in the words of Malcolm Turnbull, back when he was a back-bencher and could say what he liked.] The basic idea is that you arrange your affairs so an individual property is making a loss. You claim the loss against your income, which saves you up to 45 cents in the dollar, [for the average tax payer it’s more like 30 cents] and ideally, drops you down into a lower tax bracket.

You get the money you’ve lost back when the property appreciates in value [makes a capital gain] and you sell it. The 50% CGT discount effectively means you’re only pay tax on half of the gain. The net result? If you play your cards right, you’ve paid half as much tax on that portion of your income than you otherwise would have. Nice.

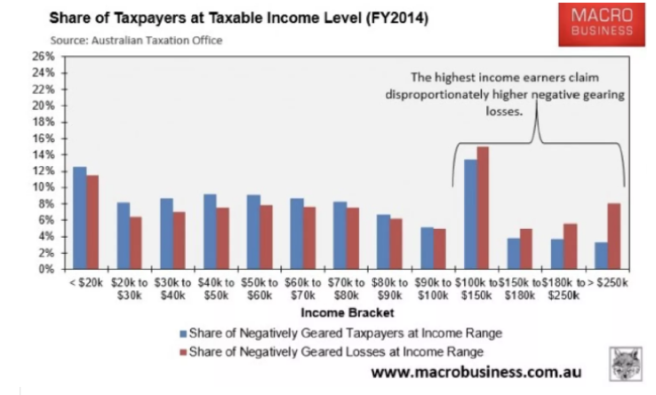

The reality is that the negative gearing trick is a lot easier to pull off if you have deep pockets. If you have the scope to arrange your affairs in the right way [e.g. use a family trust to manage income]. You can wear rental losses for a long time and you’re not going to get caught out by market declines. Deep pockets and a large portfolio of properties means you can set up the right financing arrangements, and you also have more flexibility around when you enter and exit your trades. We know that a higher portion of negative gearing losses, and negatively geared taxpayers occur at higher taxable income levels:

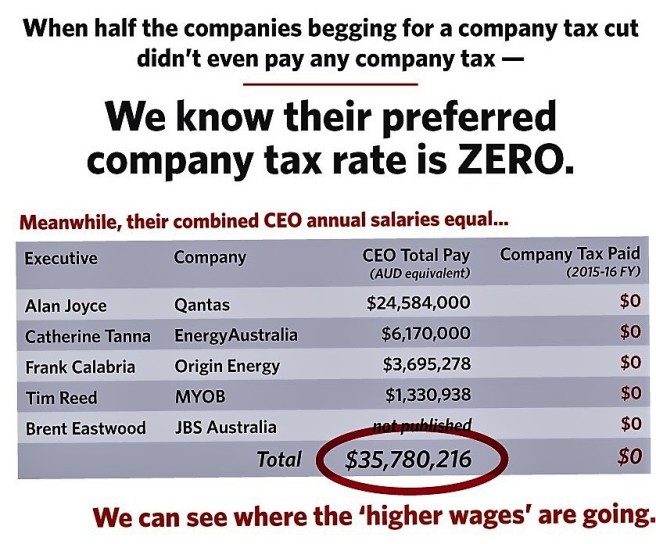

We know that higher income earners have much higher negative gearing losses. The average loss is about $10,000 a year. But the average loss for people earning more than a million dollars a year is over $45,000. The crux of the distribution of Capital Gains Tax discounts is that almost three-quarters of the benefits go to the top 10% of income earners. The capital gains tax discount overwhelming favors the rich, so the NG trick is a tax dodge for the rich. At last count, it cost the country over $13 billion in lost taxation revenue. And every time this comes up, the same old lines get trotted out – that negative gearing mostly used by mums and dads and “ordinary” investors – policemen and nurses and so on. But which electorate do you reckon uses negative gearing the most? Wentworth, yep, Battler Heartland.

And that’s the thing about the negative gearing debate. So long as there are myths about negative gearing we never get to the crux of the issue. Genius. At the same time, the rich elite have conned an army of mum and dad investors to defend their interests for them. If you’ve got a negatively geared property, you are deeply invested in the negative gearing regime. If negative gearing goes, all you’ve got is a property bleeding you of cash. No one wants that.

And so even though the benefits of the trick overwhelmingly go to the rich, and even though negative gearing has hamstrung a generation of investors, the most vocal defenders of the system are the ones the system is failing to serve. None of this was an accident. The ignorant voters are getting played like a fiddle. One of the amazing things about this campaign to protect the trick is the amount of misinformation produced by the PCA and the real estate industry. Here’s a couple of myths:

Negative Gearing helps bring Supply to the market

The truth is that 93% of investors buy existing properties. Only 7% buy new properties that increase the housing stock – owner-occupiers do much more heavy lifting here.

Removing Negative Gearing will cause House Prices to Fall

This is inconsistent with the first claim, but it doesn’t stop those with a vested interest trotting them out in the same breath. If the first is true, then removing negative gearing should reduce housing supply, and prices should actually rise. But the first isn’t true, and it seems negative gearing does little for supply. That means it should have little impact on prices… or rents…

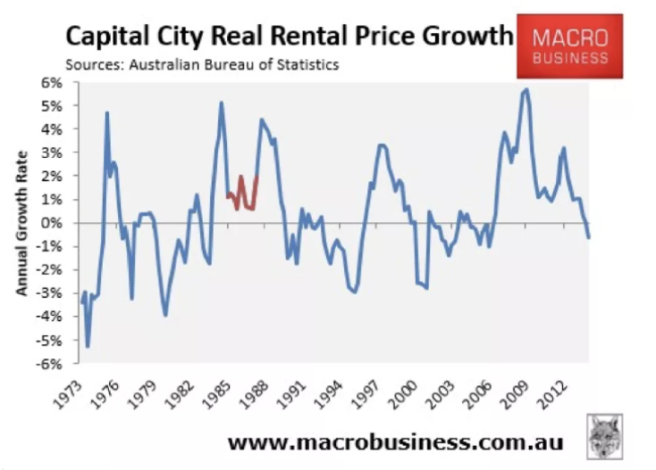

Rents soared last time we removed negative gearing.

This is one of the most popular myths, and refers to the time Labor removed negative gearing between 1985-1987. The truth of it is that it was a mixed bag across the states during this time. Rents rose in Sydney and Perth, but fell in every other capital city, leaving the national market flat over all. If negative gearing had any impact on rents, it certainly wasn’t consistent from city to city, and you can’t see it here in the data. But if it wasn’t about the so called ‘landlord strike’, why did Labor reinstate it after just two years..? Remember the powerful vested interests! An analysis of the Parliamentary members interest register shows that practically every politician has negatively geared properties; the previous Member for Solomon had 14! Not dodging tax she is reputed to have said, simply providing for my retirement.

It’s only temporary, it’s the bottom of the cycle, things will pick up soon.

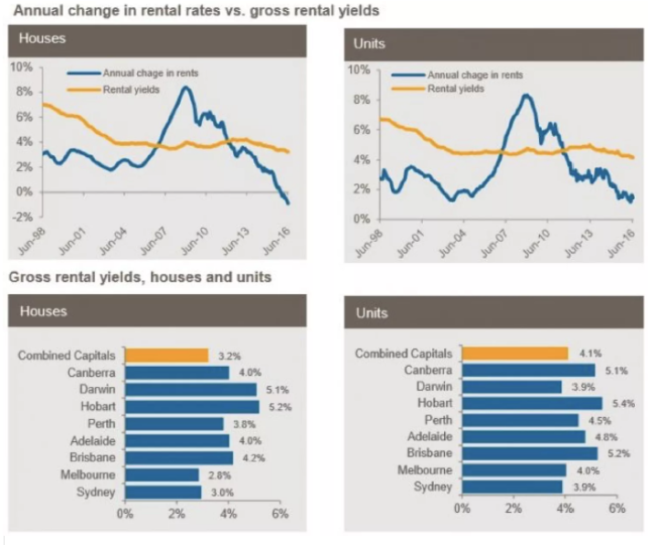

It might be tempting to say, so the rich are screwing the poor. That always happens. At least no one got hurt. And that’s true to an extent, as it ever was. The last decade was as good as it gets, interest rates were low, rental yields were high. That made the negative gearing strategy look a lot better than it actually is. But the good times are evaporating. Interest rates have fallen steadily over the past decade or so, to a 50 year low. But they can’t go any further. As a small open economy we can’t go to zero like the big boys, so that means once you’ve hit rock bottom, there’s only one way rates can go: up.

Or take rents. In a low interest rate environment – the yield on assets is also low, since the first is a foundation for the second. We’re seeing that with rental yields, that have also fallen to historical lows in recent years. This is keeping downward pressure on rental growth. That leaves wages growth to do the heavy lifting in driving rents, but wages are going nowhere. And so rental growth has been falling since the GFC. In fact, in the detached housing market, rental growth has recently turned negative for the first time since records began. Rents are already falling.

This has serious implications for a negative gearing strategy. If interest rates hold, and rents go nowhere, then a negatively geared property remains negatively geared … indefinitely. So for the time being, that means investors can’t rely on macro-economic forces turning their negatively geared duds into positively geared cash flow performers. But imagine if rates rise [in reality, the only direction they can go] or if rents fall!. That means a negatively geared property starts bleeding more cash. How long can the ‘ordinary investor – you know, the nurses and police’ support it? The rich folks will be alright. They’ll just ride it out or rearrange their affairs. But the little people will be bleeding from a wound that they can’t heal. To top it all off, what will happen when the letter comes from the bank telling Mr and Mrs Average that their interest only loan has been converted to capital plus interest and will cost an extra $7,000 per year?

It’s the story of ordinary investors being mobilized to defend a system designed by the rich to benefit the rich. But don’t jump the gun. If you’re still in the construction phase of your portfolio – if you are still acquiring assets and establishing an income stream to give you a bit of distance from the 9 to 5, then stay the hell away from negative gearing, it was not designed to serve you. In fact, it was designed to make investors nervous about their position and more easily mobilized into political action.

So when you read the REINT rant about Labor’s plan to change negative gearing [changes that will not harm existing ‘investors’] or the PCA predicting the sky will fall in, recognize it as myth, bullshit designed to protect the rich and the vested interests. God forbid the real estate salesmen will have to live on a paltry $200,000 derived from the commission extracted from the poor ignorant investors who never really understood the negative gearing trick. If you start campaigning for political change you’re going up against some powerful vested interests and change isn’t going to come easily. But send a copy of this to your local MP demanding the system change to protect the little bloke. And in the mean time, protect yourself and your family. Because negative gearing isn’t the real villain here. Ignorance is.

https://www.youtube.com/watch?v=CiaHiU6Otk8

You are no doubt aware that many thousands of Territorians are now, or will soon will be, in severe mortgage stress. The worst effected are those ‘little’ people who were seduced by the hype and invested in a DHA house that has now decreased in value. The solution for the Territory is relatively simple. Several papers by AHURI have been produced over the last decade which have identified the problem and proposed solutions. The Territory is better placed than most of the states because of the focus on regional development and with the proceeds of the sale of TIO, the NAIF and the recently announced Cities Deal, the capital necessary to seed the rescue vehicle is available. Time is of the essence! If the NTG is unable to put together a rescue before March 2019 the exit from the Territory to places with lower rents will reach a flood, the residential property market here will fall into the abyss and turn into a panic where the only winners will be the banks and those who can afford to pick up the pieces for a song. If politicians don’t put together a rescue the very fabric of the Territory will be torn, perhaps irrevocably – send this video to your MP and beg them to save the property market.

as it contains this stunning quote by ACIL Allen, an industry-based consultant famed for its pro-gas industry reports:

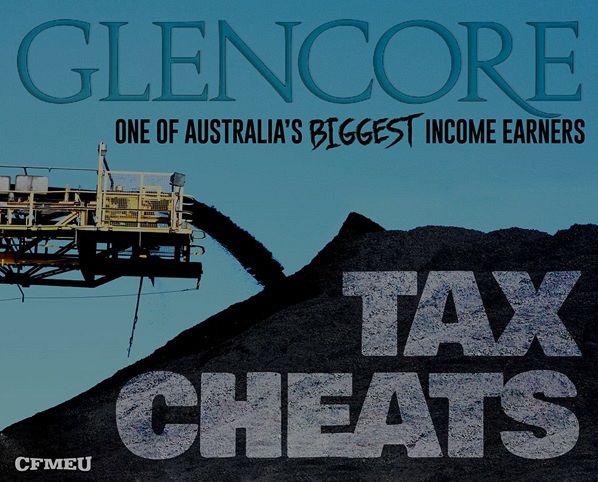

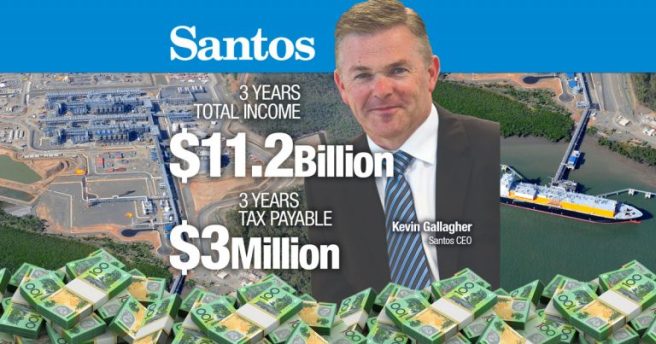

as it contains this stunning quote by ACIL Allen, an industry-based consultant famed for its pro-gas industry reports: any PRRT for many years to come – the companies themselves concede it will be 2029 – and no royalties apply. Only 13% of this new gas capacity is owned by an Australian based company, Woodside, which counts Shell as its key shareholder with 13%. Unless prices spike higher, however, these five monster projects may never pay a cent in royalties or Petroleum Resource Rent Tax (PRRT). Unless the aggressive tax structuring of the oil majors is met with equally aggressive enforcement by government, the world’s biggest oil companies – Chevron, Exxon, BP and Shell – will pay very little in income tax too. Billions each year in profit from extracting Australia’s natural resources will be funneled offshore.

any PRRT for many years to come – the companies themselves concede it will be 2029 – and no royalties apply. Only 13% of this new gas capacity is owned by an Australian based company, Woodside, which counts Shell as its key shareholder with 13%. Unless prices spike higher, however, these five monster projects may never pay a cent in royalties or Petroleum Resource Rent Tax (PRRT). Unless the aggressive tax structuring of the oil majors is met with equally aggressive enforcement by government, the world’s biggest oil companies – Chevron, Exxon, BP and Shell – will pay very little in income tax too. Billions each year in profit from extracting Australia’s natural resources will be funneled offshore.

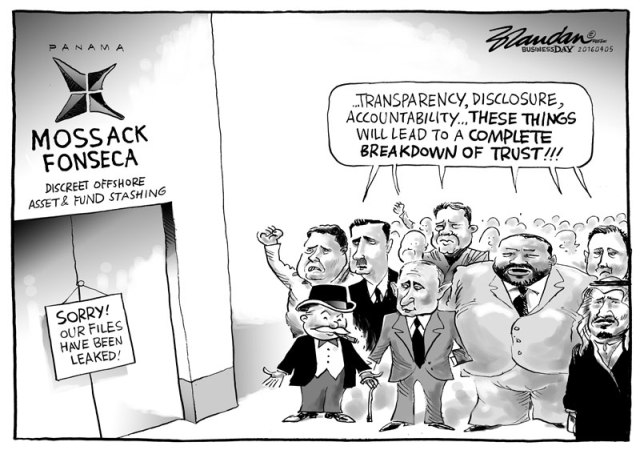

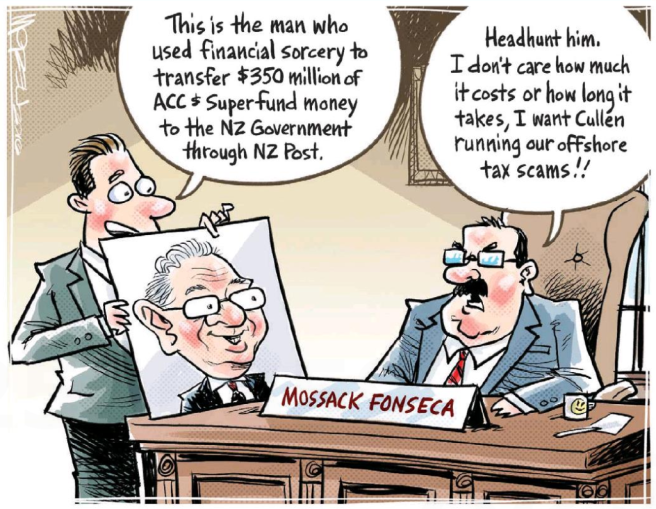

Here is an organisation which helps itself, whenever it can, to government mandates, but claims nobody except itself has an interest in viewing its financials. For its part, SABMiller in Australia is six times the size of Goldman Sachs. It churns out $3.5 billion in total income selling Australian beer to Australians. One of the tools of trade of the multinational tax avoider is keeping a low profile, keeping stakeholders, including the Tax Office, in the dark while maintaining the pretense that everything is legal. The financial statements of the holding companies of both Goldman Sachs and SABMiller in Australia are frankly useless. While claiming to follow the accounting standards, they conceal the true state of the financial affairs of the group.

Here is an organisation which helps itself, whenever it can, to government mandates, but claims nobody except itself has an interest in viewing its financials. For its part, SABMiller in Australia is six times the size of Goldman Sachs. It churns out $3.5 billion in total income selling Australian beer to Australians. One of the tools of trade of the multinational tax avoider is keeping a low profile, keeping stakeholders, including the Tax Office, in the dark while maintaining the pretense that everything is legal. The financial statements of the holding companies of both Goldman Sachs and SABMiller in Australia are frankly useless. While claiming to follow the accounting standards, they conceal the true state of the financial affairs of the group.